AMD Hits Record High Share in x86 Desktops and Servers in Q1 2024

by Anton Shilov on May 10, 2024 7:00 AM EST

Coming out of the dark times that preceded the launch of AMD's Zen CPU architecture in 2017, to say that AMD has turned things around on the back of Zen would be an understatement. Ever since AMD launched its first Zen-based Ryzen and EPYC processors for client and server computers, it has been consistently gaining x86 market share, growing from a bit player to a respectable rival to Intel (and all at Intel's expense).

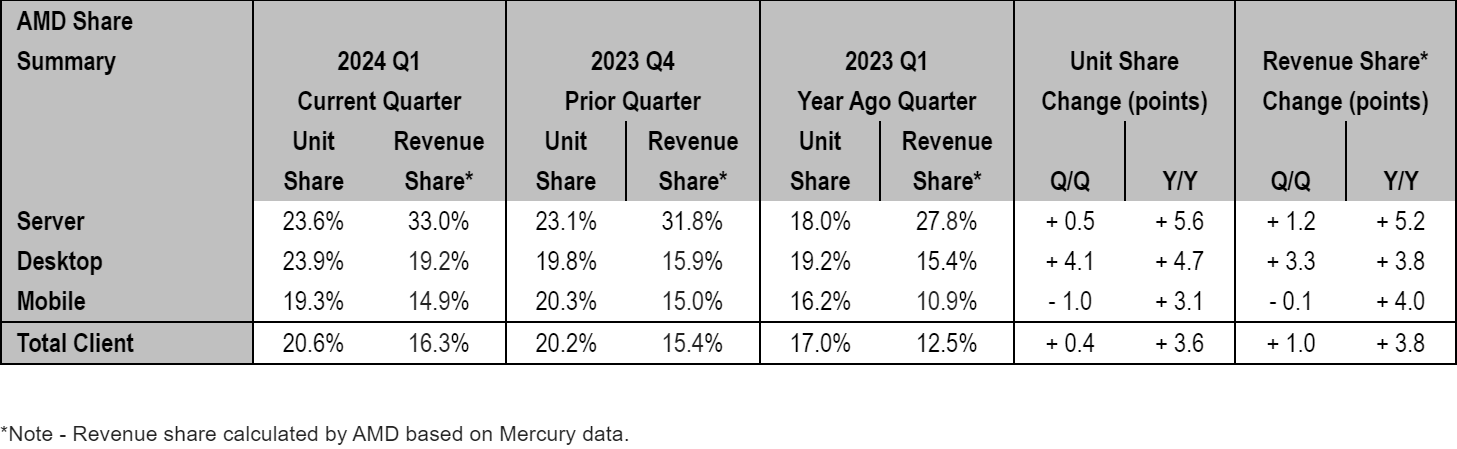

The first quarter of this year was no exception, according to Mercury Research, as the company achieved record high unit shares on x86 desktop and x86 server CPU markets due to success of its Ryzen 8000-series client products and 4th Generation EPYC processors.

"Mercury noted in their first quarter report that AMD gained significant server and client revenue share driven by growing demand for 4th Gen EPYC and Ryzen 8000 series processors," a statement by AMD reads.

Desktop PCs: AMD Achieves Highest Share in More Than a Decade

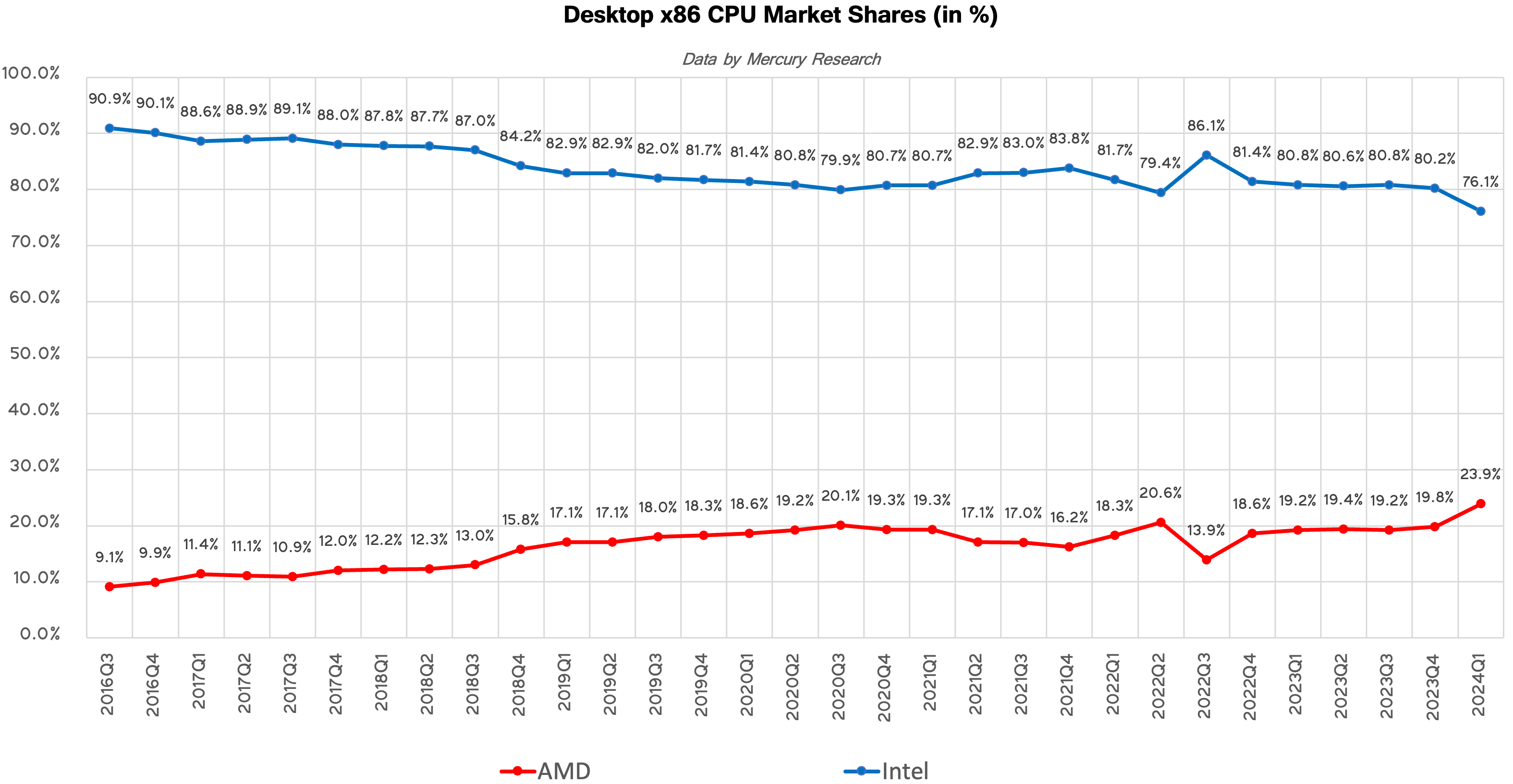

Desktops, particularly DIY desktops, have always been AMD's strongest market. After the company launched its Ryzen processors in 2017, it doubled its presence in desktops in just three years. But in the recent years the company had to prioritize production of more expensive CPUs for datacenters, which lead to some erosion of its desktop and mobile market shares.

As the company secured more capacity at TSMC, it started to gradually increase production of desktop processors. In Q4 last year it introduced its Zen 4-based Ryzen 8000/Ryzen 8000 Pro processors for mainstream desktops, which appeared to be pretty popular with PC makers.

As a result of this and other factors, AMD increased unit sales of its desktop CPUs by 4.7% year-over-year in Q1 2024 and its market share achieved 23.9%, which is the highest desktop CPU market share the company commanded in over a decade. Interestingly, AMD does not attribute its success on the desktop front to any particular product or product family, which implies that there are multiple factors at play.

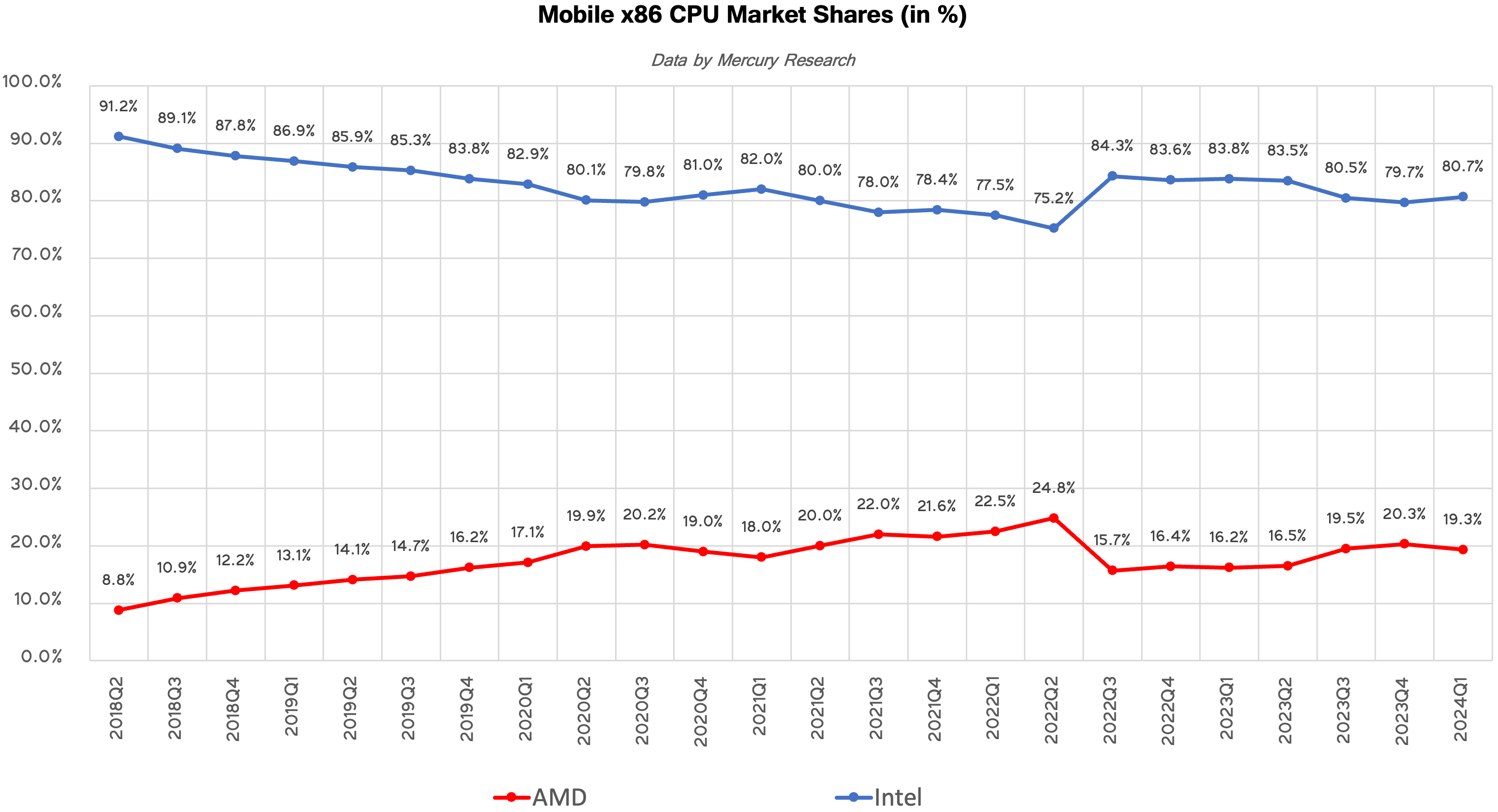

Mobile PCs: A Slight Drop for AMD amid Intel's Meteor Lake Ramp

AMD has been gradually regaining its share inside laptops for about 1.5 years now and sales of its Zen 4-based Ryzen 7040-series processors were quite strong in Q3 2023 and Q4 2023, when the company's unit share increased to 19.5% and 20.3%, respectively, as AMD-based notebook platforms ramped up. By contrast, Intel's Core Ultra 'Meteor Lake' powered machines only began to hit retail shelves in Q4'23, which affected sales of its processors for laptops.

In the first quarter AMD's unit share on the market of CPUs for notebooks decreased to 19.3%, down 1% sequentially. Meanwhile, the company still demonstrated significant year-over-year unit share increase of 3.1% and revenue share increase of 4%, which signals rising average selling price of AMD's latest Ryzen processors for mobile PCs.

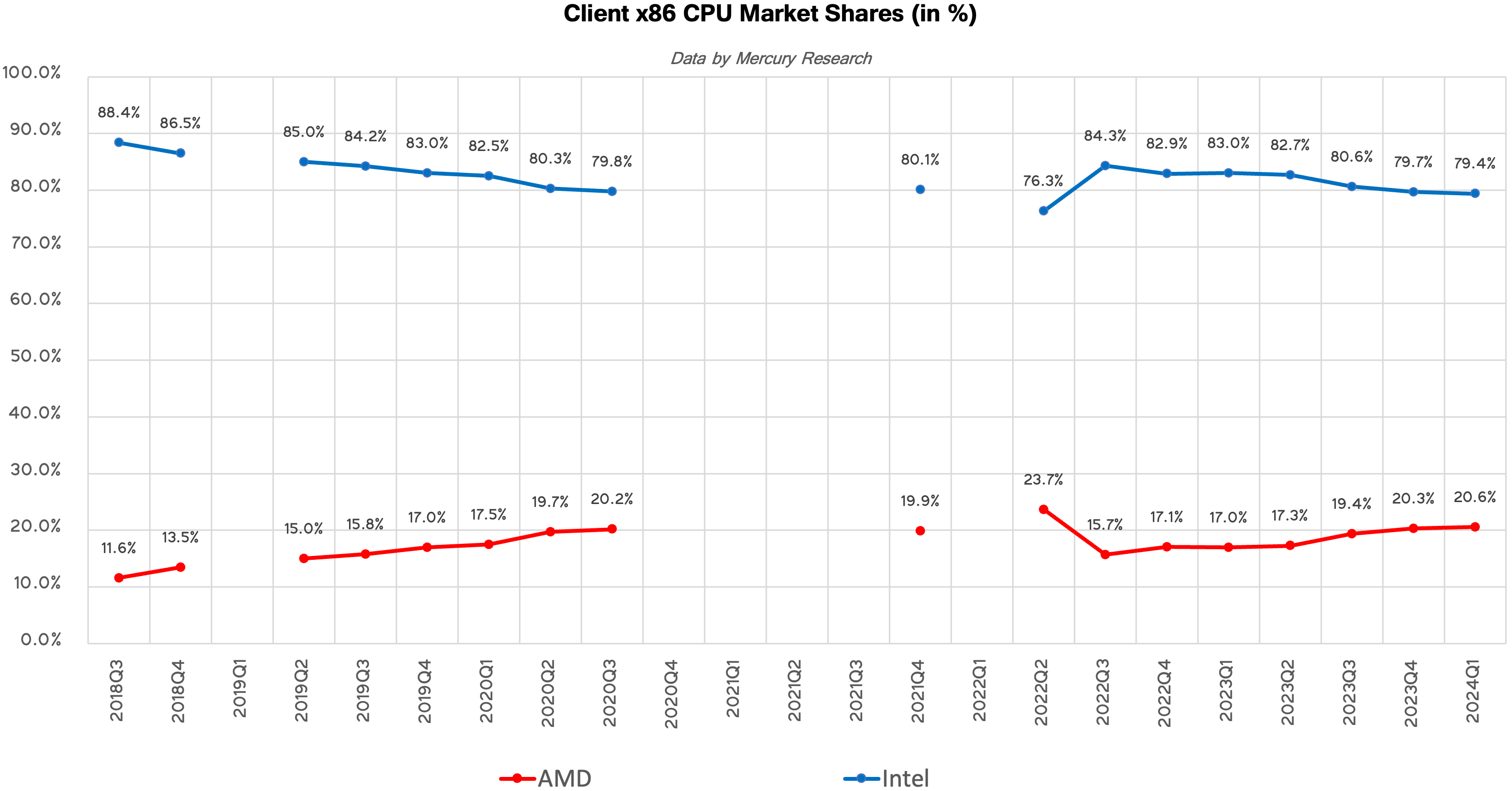

Client PCs: Slight Gain for AMD, Small Loss for Intel

Overall, Intel remained the dominant force in client PC sales in the first quarter of 2024, with a 79.4% market share, leaving 20.6% for AMD. This is not particularly surprising given how strong and diverse Intel's client products lineup is. Even with continued success, it will take AMD years to grow sales by enough to completely flip the market.

But AMD actually gained a 0.3% unit share sequentially and a 3.6% unit share year-over year. Notably, however, AMD's revenue share of client PC market is significantly lower than its unit share (16.3% vs 20.6%), so the company is still somewhat pigeonholed into selling more budget and fewer premium processors overall. But the company still made a strong 3.8% gain since the first quarter 2023, when its revenue share was around 12.5% amid unit share of 17%.

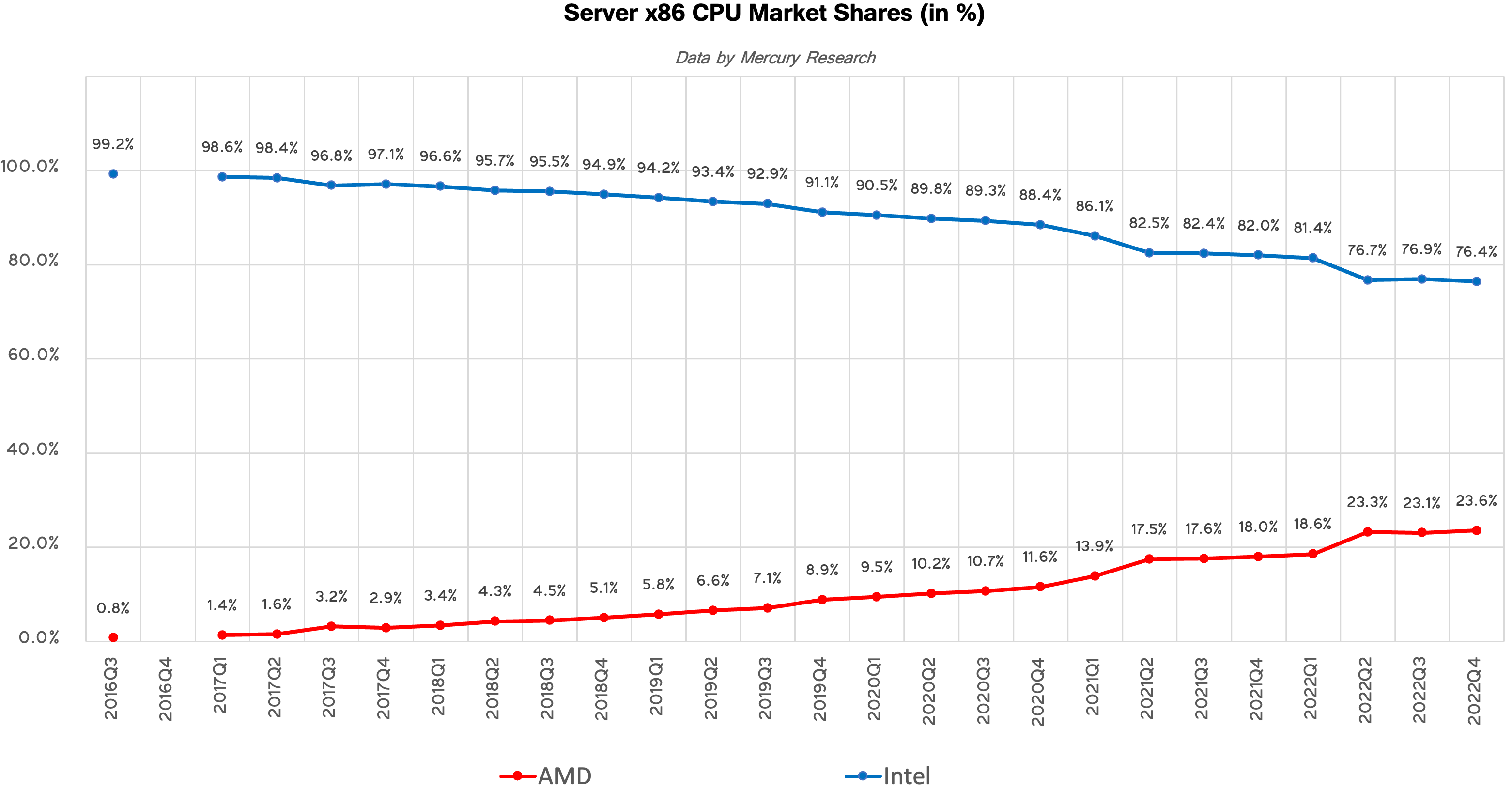

Servers: AMD Grabs Another Piece of the Market

AMD's EPYC datacenter processors are undeniably the crown jewel of the company's CPU product lineup. While AMD's market share in desktops and laptops fluctuated in the recent years, the company has been steadily gaining presence in servers both in terms of units and in terms of revenue in the highly lucrative (and profitable) server market.

In Q1 2024, AMD's unit share on the market of CPUs for servers increased to 23.6%, a 0.5% gain sequentially and a massive 5% gain year-over-year driven by the ramp of platforms based on AMD's 4th Generation EPYC processors. With a 76.4% unit market share, Intel continues to dominate in servers, but it is evident that AMD is getting stronger.

AMD's revenue share of the x86 server market reached 33%, up 5.2% year-over-year and 1.2% from the previous quarter. This signals that the company is gaining traction in expensive machines with advanced CPUs. Keeping in mind that for now Intel does not have direct rivals for AMD's 96-core and 128-core processors, it is no wonder that AMD has done so well growing their share of the server market.

"As we noted during our first quarter earnings call, server CPU sales increased YoY driven by growth in enterprise adoption and expanded cloud deployments," AMD said in a statement.

Source: AMD, based on data from Mercury Research

44 Comments

View All Comments

PeachNCream - Tuesday, May 14, 2024 - link

"*Not that you can throw any stones."Heh! Totally fair and no argument from me, but it is hard to resist the low hanging fruit of a decent portion of the PC enthusiast sub-group. They're so...well you know what I mean. You're lucid enough to get it, obviously.

Bruzzone - Tuesday, May 14, 2024 - link

Mt response here and to all of PC Media land who got caught up in the AMD, Mercury, Shilov q1 2024 puff piece where not ONE single assessment of the Mercury data specific AMD is true, in fact misrepresented can be found here;https://seekingalpha.com/user/5030701/comments

Just expand the comment line for all the gory details.

mb

Terry_Craig - Tuesday, May 14, 2024 - link

Definitely sounds like a Russian "Not ONE single"Bruzzone - Tuesday, May 14, 2024 - link

I've asked Anton to rewrite the correction and Ryan the Gavin have the same opportunity. Anton's take is very much misrepresented presenting basically an invented assessment. Original AMD q1 desktop and server said "AMD UP / GAINS" specific q1 on the actual data was also very much misrepresented and I have communicated with AMD corporate investigations and Chief legal on this topic who follow all my data not just this data. The fact is AMD concealed a down quarter in server and desktop subject run end volumes in the quarter, the server and desktop generation transition ahead and a deflationary price slide for existing PC generations into q1 2025. AMD is also concealing that AMD has a product laundering issue on the amount of unreported revenue units going out as bundle deal presenting AMD channel 'product category' shares well in excess of that which can be determined from the financial alone. This has been known for over 5 years and yes in q1 someone attempted to conceal that who are AMD and the beneficiaries of the unreported revenue units as sales close incentive in volume procurements. There is also a suspect internation extort tariff question for country access, commerce operation and political leave, TC I tend to agree with you but its more than solely a doing business in Russian issue, all over Asia Pacific, South America, even in the United States where OEMS are engaged in brokerage resale of AMD and Intel components to down stream channels. mb